REMLOPRO

Watch this short Webinar!

Want to get paid on the mortgage loans associated with your transactions. . . without getting an individual state mortgage license?

What is a REMLOPro?

A Real Estate Mortgage Loan Originator

Exclusively for select top producing agents

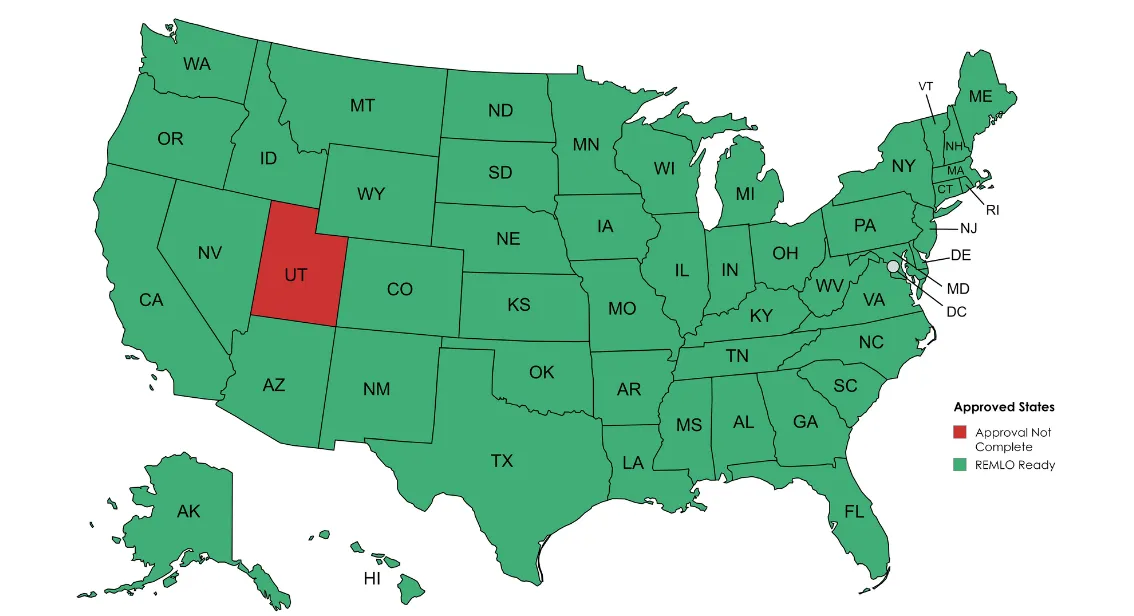

Gives you the ability to offer purchase and refinance lending services to your clients in ALL 50 STATES!

“White Glove” Concierge team handles the loan production process for you

Allows you to earn a commission for your buyer clients who choose to work with you

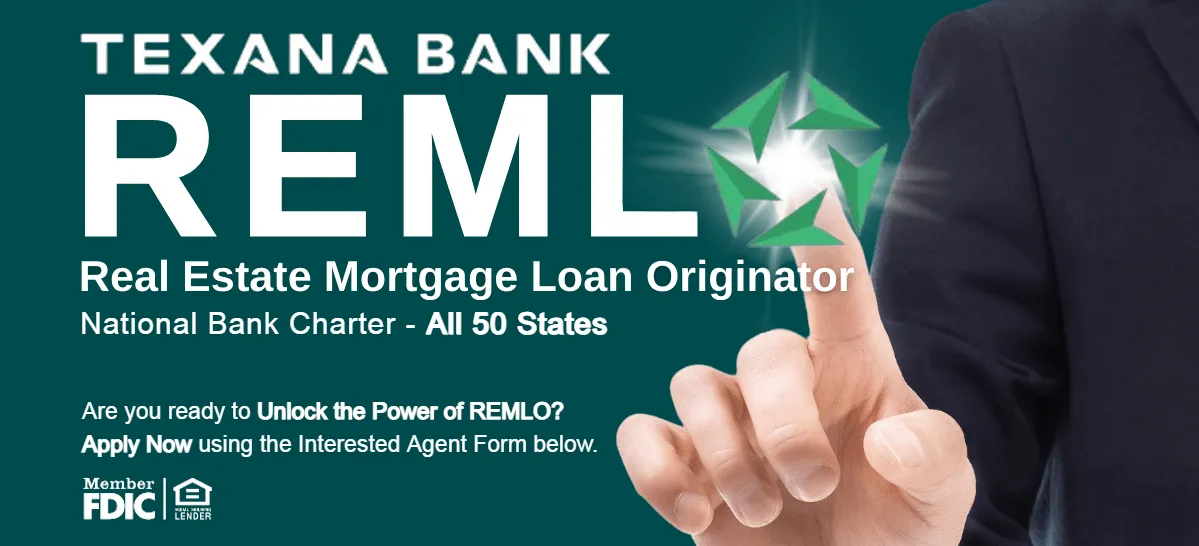

Who is behind the REMLO program?

Texana Bank is a federally chartered FDIC Insured institution founded in Linden, Texas in 1914. In the last 100 or so years, their mission has become clear, to lend money. To his end, they are not only a bank, but also a correspondent lender with more than 30 correspondent relationships and also a broker with more than 70 other financial institutions. This means that they can competitively offer the right program to virtually anyone.

When HUD removed loan officers from their definition of conflict of interest in 2022, Texana Bank recognized the vast untapped market of Real Estate professionals who are involved with millions of transactions that require mortgage financing every year who could be empowered to originate loans under the bank’s license in all 50 states. The concept of the Real Estate Mortgage Loan Officer REMLO was born.

So What Exactly is a REMLOPro, again?

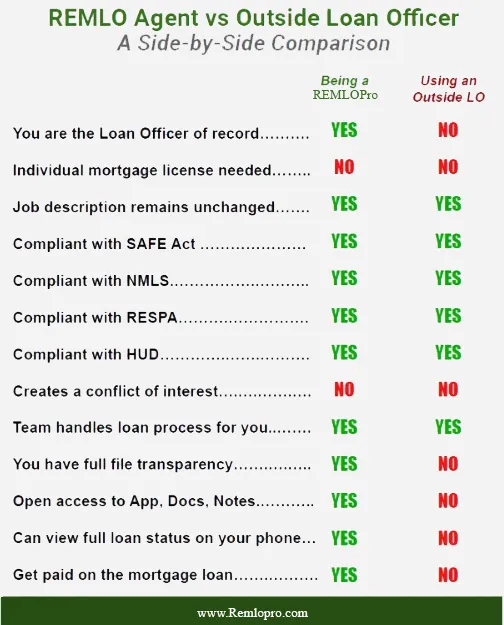

A REMLOPro is a Real Estate Professional who is also Mortgage Loan Officer. This statement normally raises a number of “yeah, but....” kind of questions. This chart is a quick guide that will help to answer some of them.

Again, the quick explanation is that in addition to earning your normal Real Estate commission, the REMLO program allows you to earn a commission on the mortgages associated with your Real Estate transactions. The key things to remember:

You do NOT need a individual mortgage license because you legally write under the banks federal license in all 50 states.

You don’t need to know or learn the loan production process because your “White Glove” Loan Concierge Team handles the loans for you from application to closing.

What does a REMLOPro do?

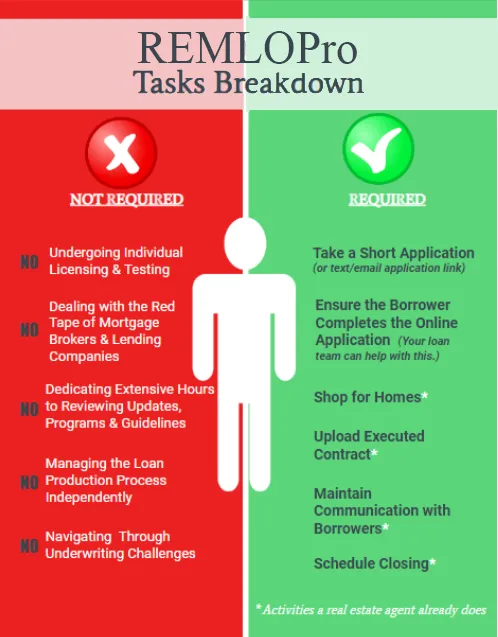

Perhaps the better question is “What does a REMLOPro NOT do or not HAVE TO do?

Reviewing this chart, we’ve been able to remove the onerous tasks that normally make Real Estate professionals think twice about becoming a loan officer.

On the “right” side, taking the app used to mean completing a paper 1003 at the clients' dining table, now it is simply conveying your link to them. Once that is started, your team can help from there, making sure that it is completed properly.

The other green tasks should look familiar as the RE Agent is already doing them.

About us

Amy Brand

Mortgage Pro / Investor

NMLS #2594114

Amy Brand & Jennifer L. Huber

REMLOPro's

Amy and Jennifer, with over 25 years in real estate, lending, and investment, joined forces to empower entrepreneurs. Their shared expertise in creative financing, affordable housing, and franchising fuels their mission to enrich lives personally, professionally, and spiritually. Centered around the pillars of People, Properties, and Purpose, they focus on Leadership Development, Mental Health & Wellness, and Creative Investing, aiming to instill values and build a lasting legacy.

Today, Amy and Jennifer's vision has expanded to include assisting real estate professionals in leveraging recent legal changes that permit them to be compensated on mortgage loans nationwide. This program is fully compliant with the SAFE Act, NMLS, RESPA, and HUD, ensuring no conflict of interest. This initiative is more than a business strategy; it represents a paradigm shift in the mortgage and real estate industries.

This expansion is more than just a business strategy it's a paradigm shift in the mortgage and real estate industries that bridges the gap between real estate professionals and Loan Originator, fostering more informed decisions, improved client service, and enhanced profitability.

Jennifer L. Huber

Real Estate Pro / Investor

NMLS #103259

eAgent Exhale MS-S#57986

Meet your “White Glove” Loan Concierge Team

Lynette Heck

Mortgage Loan Assistant NMLS# 685903

Jeremy Crooks

Mortgage Branch Manager, NMLS #326273

Victoria Pickreign

REMLOPro NMLS #2630284

Max Muñoz

REMLOPro NLMS #2617262

Find Out How Much It’s Costing You NOT to Be A REMLOPro Check Out Our “Stop Losing Money“ Calculator 😂

How much money are YOU losing each month by NOT being a REMLOPro? You might be thinking “That’s crazy! I’m not losing money.” Really? What do you think is happening every time you GIVE AWAY a mortgage loan to an outside Loan Officer? (Not hatin’, just statin’ 😂) To bring that into clear focus,

download this calculator to run some different scenarios.

Keep in mind that this calculator simply creates estimates based on your input. Neither it nor we can imply nor guarantee the results as there are too many individuals, companies, and factors involved in procuring a loan, over which we have zero control and which can change quickly without notice.

Having said that, take It for a spin and have a little fun. If you need help with the calculator, view the short tutorial video.

REMLO MAP

REMLO Q&A Video Series

FAQs

How does this work?

Easy. As a Real Estate professional, you become a loan officer for Texana Bank. Instead of referring your clients who need financing to an outside loan officer, “you” do the loan by refering to your inside loan partner and get paid for it. This additiional revenue can significantly boost your income.

Are you nuts? There’s no way I’m jumping those hoops to get a license.

You don’t have to. Because the rules are different for federally chartered banks than they are for other lending institutions, you don’t need to get or maintain an individual state lending license. The law states that loan officers who are the W2 employees of federally chartered institutions may originate loans under the license of the institution, and since it is a federal license, they may originate loans in all 50 states.

Wait! I’d be the Agent and LO on the same transaction?? Isn’t that a conflict of interest?

Actually, it’s not. It was only ever considered a conflict by HUD and only for FHA loans. But that changed in December of 2022 when HUD updated its “conflict” definition to exclude loan officers. It’s no longer considered a conflict by any federal governing body or organization. Note: There is a disclosure sent with the initial disclosure package that lets the client know that you’ll get paid on both sides of the table and that they are not required to use you as the LO if they have a different preference.

No thanks. I’ve already got a job! 😂

That’s the beauty of the REMLO program. With your “White Glove” loan concierge team, you don’t need to learn the loan production process. Your team will handle the loan from application to closing. Your job description really doesn’t change. Right now, you refer your buyer to a loan officer and they handle the process. With REMLO, you’ll simply text or email your application link, refer them to your (inside) loan partner and your loan team will handle the process. It will work the same except with REMLO, you’ll get paid. 🎯👍 Of course, there are normal Agent tasks to complete, i.e., shopping for houses, uploading an executed contract, communicating with the client, and scheduling the closing.

So then...how much WILL I get paid?

On the vast majority of loans, REMLOPros receive a payout of 50 basis points at closing. For easy math, that’s $5,000 for each $1 Million in loan volume. Of course, it’s paid on whatever the actual loan amount is, so a $500,000 loan would be $2,500 and a $200,000 loan would be $1,000, etc. The only exception would be if the margins were reduced for competition or some other unlikely reason. Also, you will be paid as a W2 employee because the rules that allow this program to work only apply to W2 employees. If you haven’t done so, download the REMLO Stop Losing Money Calculator to run some different scenarios.

Would I need to move to a different RE Broker?

Absolutely not! You may be a REMLOPro with any broker you choose. Your choice of broker has no bearing on your standing as an employee with Texana Bank.

Would my loan commissions come through my RE Broker like my other commissions?

No. You will receive fully compliant W2 commissions directly from the bank because you would be a W2 employee of the bank.

What loan programs can I offer?

As mentioned earlier, in addition to their own programs, Texana Bank has either Correspondent Lending or Broker relationships with more than 100 other lending sources. If each had only 20 program (this is a low estimate) that means that you will have over 2,000 programs at your disposal, covering virtually any lending need including but not limited to Conventional, FHA VA, First Time Homebuyer, Down Payment Assistance, DSCR, ITIN, Lot Loans, Land Loans, Construction (including one time close), Reverse, 2nds, Fix ‘n Flip, Non-QM, Commercial, etc.

Will my rates be out of the market or will I be competitive?

You will have broker pricing so yes, you will be extremely competitive

What if my client somehow wants/needs a program I don’t have?

That would be unusual but if they have found a program that we can’t get, they are always free to use that program with whomever is offering it. Remember, we can’t compel them to use us. They are free to choose whomever they would like.

Will my current E&O insurance cover this or will I need to get a different policy?

Neither. You will be covered by the bank’s E&O policy because you’ll be an employee. This won’t affect your current policy and you won’t need to buy a new one.

What about RESPA?

What about it? 😂 The REMLO program doesn’t change anything about RESPA. It will keep right on RESPA-ing. As a REMLOPro, you are considered a dual-capacity employee. Section 8 of the RESPA code provides an exemption to dual-capacity employees. So even though it is still there, it has no effect on REMLO.

Is this ONLY for mortgage loans associated my RE transactions?

Certainly not! As a REMLOPro, you are a full-fledged mortgage loan officer empowered to write mortgage loans for any purpose and in any state. This could be for 1st mortgages, 2nd or other subordinate mortgages, HELOCs, etc. These could be for purchases, refinances (R/T or Cashout), debt consolidation...anything!

Would I work with the same team for all of my loans?

Yes. There is no round-robin pool of Loan Partners or Loan Officer Assistants. You will work with the same awesome team on all of your loans unless and until we all decide that some change needs to be made that will somehow improve the operation.

What if I get stuck with a loan partner who is a jerk?

Let us know and we’ll assign someone else to you (who is not a jerk). 🙂👍

How much does it cost to become a REMLOPro?

Nada. Zip. Zilch. Well actually there are some nominal costs but Texana pays those on your behalf so there are no out of pocket expenses for you to get set up.

How long does it take to get setup?

That’s largely up to you. If you “get down on it”, you CAN be set up in as little a couple of weeks.

How can I keep tabs on my files?

So, right now if you want an update, you have to call your LO and ask what’s up. They can give you some general info, (should be CTC on Friday, etc), but not a lot of specifics. As a REMLO Agent, you ARE the Loan Officer of record with complete transparency to the file. You’ll just open your Simple Nexus app wherever you are and have full access to all file information. If you have further questions, just call or text your loan partner.

If I’m a Broker/Owner, will I be able to do loans for other Agents in my office and get paid on those?

Of course, you will be the bank employee and the loan officer of record for those loans and therefore the person getting paid. Whether you then pay them and how much is between you and them. Some Broker/Owners use this as an additional recruitment benefit (For further clarification, please review the answer to #13.)

Will I be able to do loans for other outside RE Agents’ deals and get paid on those too?

Yep. (For further clarification, please review the answer to #19. 😂)

So I really wouldn’t have to take any individual licensing class, pass a test or pay a licensing fee??

Nope.

Do the normal CE requirements apply to this program?

No. There is no “outside” continuing education required. The bank does have its own internal workshops and training. There are normally a couple of hours of video to view each quarter on things like fraud protection, anti-phishing, ECOA, Fair Housing, etc. There is no fee for this internal training.

If this is so great, why isn’t every Agent doing it?

We’re working on that. 😂 The fact is that after working on this for much of last year, Texana Bank just rolled REMLO out early in 2024. To our knowledge, this is the first program of it’s kind that DOES NOT require the RE Agent to get a state lending license. We’re getting the word out as quickly as we can. There are also those who didn’t get the HUD memo from December 2022 and are still living under the conflict of interest delusion. Whichever. As they say, “You can lead a horse to water....”

So...you’re telling me that I can earn a .5% commission on the mortgage loans associated with my (or anyone else’s) RE transactions, without getting my own state license, without learning the loan production process, it’s fully compliant with SAFE Act, NMLS, RESPA and HUD so there is no conflict of interest, my job description doesn’t change, I can still use my current lending arrangement if it’s better for my client, AND the bank will even pay the cost of getting me set up??? 🤔

Yep. That’s pretty much the size of it. 👍🙂🎯

How is this different from other programs that license Realtors to do mortgages?

That’s a great question and part of the answer is actually in the question. Other programs typically license the Agent. That requires taking the 20 hour course plus whatever specific state hours are required, passing the class, passing the state exam, and then actually getting the license which covers just that state. With this program, you don’t do any of that because your’re under the bank’s license AND you can do loans in ALL 50 STATES.

50 Basis points does seem like much. Isn’t that a little low?

Really? How much are you earning on mortgages now? 😂 Consider this. After averaging compensation tiers, most of the big banks don’t pay their LOs much more than that for doing all the work on the file. Here, your concierge team is doing the work on the file (after the app) and you’re getting close to the same amount.

I always give out three LOs name so I don’t appear to be directing the client?

No problem. You can certainly be one of the three names. When they learn you can help them with their loan, most people will want more information.

Ok. I’ll bite. What’s the downside?

We’ve designed this program so that the only downside is NOT doing it. Think about it. What’s worst that can happen if you do this? You decide for some reason that you like your current arrangement better and just go back to it? Now, what’s the best that can happen? It is what we say it is and you’re now collecting potentially tens of thousand in additional revenue (depending on your production) that had been going to someone else from business that YOU generated.

What is the process to get started?

Easy. Just go to www.joinREMLO.com and complete the application/survey there. That will give us your contact info and tell us a bit about your business, your volume, etc. Once that has been submitted and reviewed, our team will share our HR link to get started. You’ll upload your resume if you have one(no worries if you don't, just submit without). If not, you’ll just enter where you’ve had your license the last 2 years or since you’ve been in the biz if less than that Jeremy, the most excellent Branch Manager, will send you an offer letter, normally in 24-48 hours. Once that has been E-Signed, Texana Bank HR will reach out and help you get onboarded. 🎯If you need help, Amy, Jennifer and team are there to help you move through the process smoothly and complete your onboarding as quickly and painlessly as possible.

The REMLOPro Podcast

iTs Time

Amy Brand

Mortgage Loan Officer

NMLS# 103259

Mailing Address

1113 Ames Ave. Ocean Springs, MS, 39564

Phone : 228-200-1091

Email Address [email protected]

Jennifer L. Huber

REMLOPro Leader

NMLS# 2594114

eAgent Exhale MS-S#57986

Phone : 228-200-1091

Email Address:

[email protected]

Jennifer L. Huber

Mortgage Loan Originator

NMLS# 2594114

eAgent Exhale# S57986

Mailing Address

1113 Ames Ave. Ocean Springs, MS, 39564

Phone : 228-200-1091

Email Address [email protected]

Questions? Contact Amy Brand | Mortgage Loan Officer| [email protected]| Phone: 228-200-1091

Texana Bank NMLS # 407536 | Amy Brand NMLS# 103259 | Terms & Conditions | Privacy Policy | NMLS

Mailing Address: 1113 Ames Ave, Ocean Springs, MS, 39564 |

All products may be subject to credit check and other approvals.

** Investment services are not FDIC-insured, not a deposit, not bank guaranteed, not insured by any federal government agency, and may go down in value.

NOTICE OF EXPIRATION OF THE TEMPORARY FULL FDIC INSURANCE COVERAGE FOR NONINTEREST-BEARING TRANSACTION ACCOUNTS

By operation of federal law, beginning January 1, 2013, funds deposited in a noninterest-bearing transaction account (including an Interest on Lawyer Trust Account) no longer will receive unlimited deposit insurance coverage by the Federal Deposit Insurance Corporation (FDIC). Beginning January 1, 2013, all of a depositor's accounts at an insured depository institution, including all noninterest-bearing transaction accounts, will be insured by the FDIC up to the standard maximum deposit insurance amount ($250,000), for each deposit insurance ownership category. For more information about FDIC insurance coverage of noninterest-bearing transaction accounts, visit: https://www.fdic.gov/deposit.